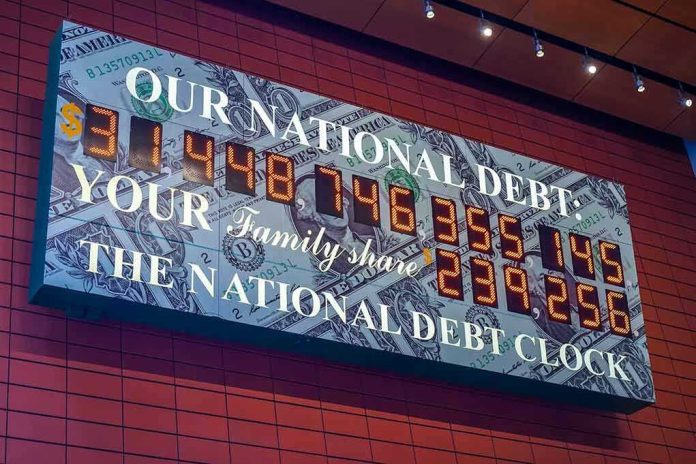

America’s national debt just smashed past $38.40 trillion, piling $284,914 onto every household—imagine that IOU landing in your mailbox tomorrow.

Story Snapshot

- U.S. gross national debt reached $38.40 trillion as of December 3, 2025, up $2.23 trillion from last year.

- Daily increases average $6.12 billion, or $70,843 per second, projecting $39 trillion by March 2026.

- Net interest payments hit $981 billion over the past year, tripling from five years ago at a 3.382% average rate.

- Per-person burden stands at $112,881; per-household equivalent reaches $284,914 amid economic growth.

- Republican-led Joint Economic Committee warns of unsustainable fiscal path despite revenue gains.

Debt Milestone Accelerates Amid Shutdown Chaos

The U.S. national debt struck $38 trillion on October 23, 2025, during a 23-day federal government shutdown. Treasury data confirmed the surge to $38.396 trillion by November, culminating at $38.40 trillion on December 3 per Joint Economic Committee reports. Congress failed to resolve spending disputes, forcing Treasury to borrow aggressively. This marked the first breach of the $38 trillion threshold, with debt held by the public and intragovernmental holdings both expanding rapidly.

Republicans on the JEC spotlighted the per-household load of $284,914, arguing fiscal recklessness persists even as the economy grows. Common sense dictates households cannot sustain endless borrowing; facts show interest costs now eclipse prior defense budgets, squeezing future priorities like defense and Social Security.

FY2025 ended with a $1.8 trillion deficit, revenues up 6% but outlays rising 3% over FY2024. August’s cumulative deficit alone hit $2.0 trillion, fueling the debt spike. Bipartisan trackers confirm persistent trillion-dollar shortfalls annually.

Interest Payments Explode to Record Levels

Net interest on the debt reached $981 billion for the 12 months through October 2025, nearly triple the amount five years prior. Average interest rate on marketable debt climbed to 3.382%, more than double the 1.583% from 2020. Federal Reserve rate policies amplified these costs, with projections for interest to claim 13.85% of FY2026 outlays and 14.52% by FY2028.

Congressional Budget Office data underscores the squeeze: higher rates during economic expansion signal deeper troubles ahead. Conservative principles favor balanced budgets; unchecked interest diverts funds from tax relief and infrastructure, burdening working families with avoidable inflation risks.

Debt-to-GDP ratio hit 124.30% by December 2024, with public debt at 77% of GDP earlier in 2025, eyeing 100% by 2028. Historical surges post-2008 and COVID-19 set precedents, but current growth rates outpace them.

Household and Taxpayer Burdens Mount Daily

Every American shoulders $112,881 in total debt, rising $6,567 per person annually. Households face $284,914 equivalents, calculated across 115 million full-time households. Daily additions of $6.12 billion translate to $255 million hourly, etching deeper into family finances.

Lower-income communities suffer most as borrowing sustains deficits over $1 trillion yearly. Political shutdowns like October’s exacerbate delays in reforms, prioritizing partisan standoffs over fiscal discipline—a failure of leadership by common-sense standards.

Projections warn of $39 trillion by March 6, 2026, based on three-year averages. Short-term strains crowd out program spending; long-term threats include elevated rates and eroded global confidence in U.S. bonds.

Sources:

https://en.wikipedia.org/wiki/National_debt_of_the_United_States

https://tradingeconomics.com/united-states/government-debt

https://bipartisanpolicy.org/report/deficit-tracker/

https://fred.stlouisfed.org/series/GFDEGDQ188S

https://www.congress.gov/crs-product/IN12045